Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Balance sheets also play an important role in securing funding from lenders and investors. For instance, accounts receivable should be continually assessed for impairment and adjusted to reveal potential uncollectible accounts. These ratios can yield insights into the operational efficiency of the company. These operating cycles can include receivables, payables, and inventory.

- Marshalling refers to the arrangement of assets and liabilities on the balance sheet in a particular order.

- Balance sheets are invaluable when evaluating investment opportunities.

- External auditors, on the other hand, might use a balance sheet to ensure a company is complying with any reporting laws it’s subject to.

- Because of this, managers have some ability to game the numbers to look more favorable.

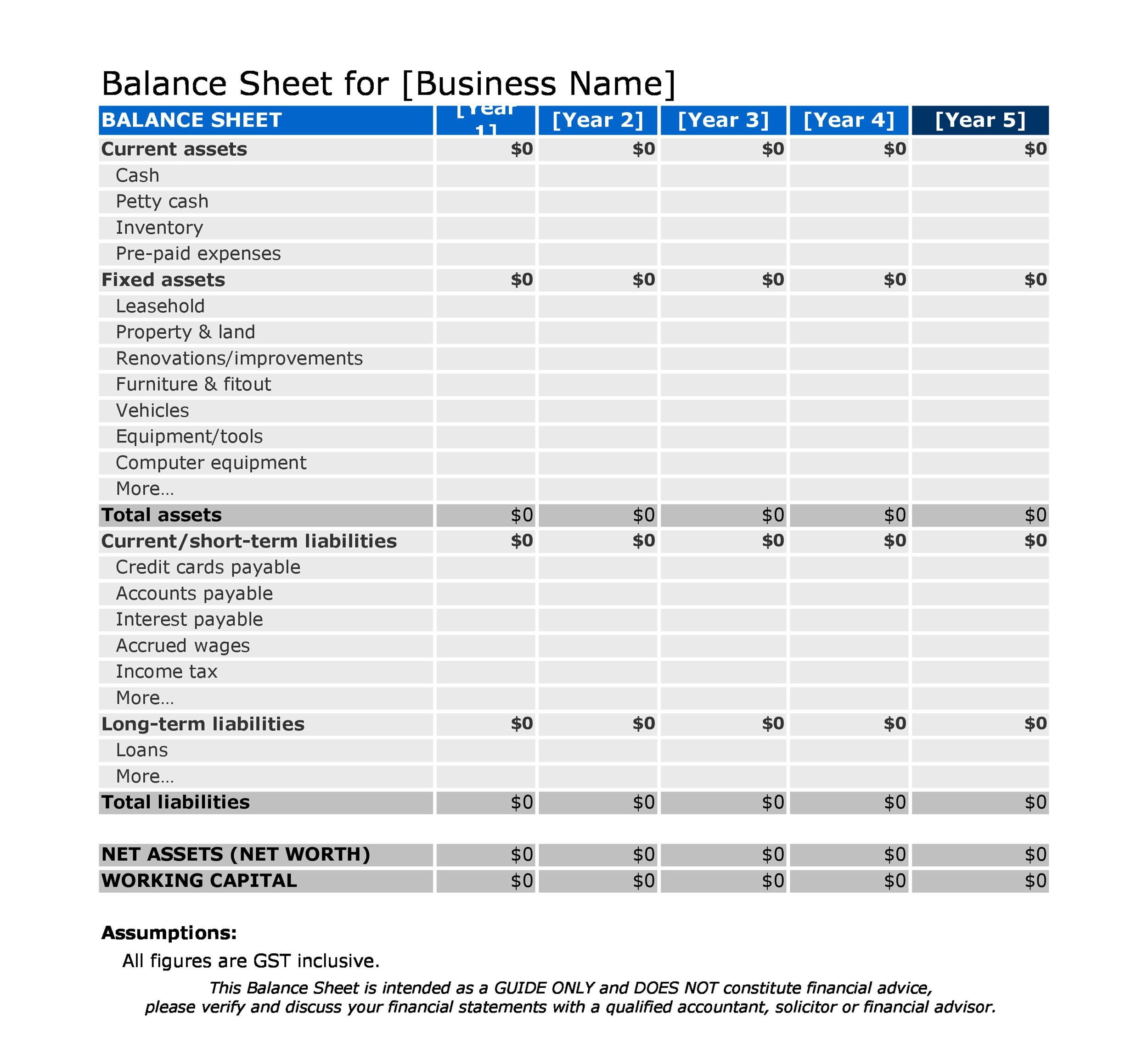

- It lets you see a snapshot of your business on a given date, typically month or year-end.

Balance sheet formula & equation

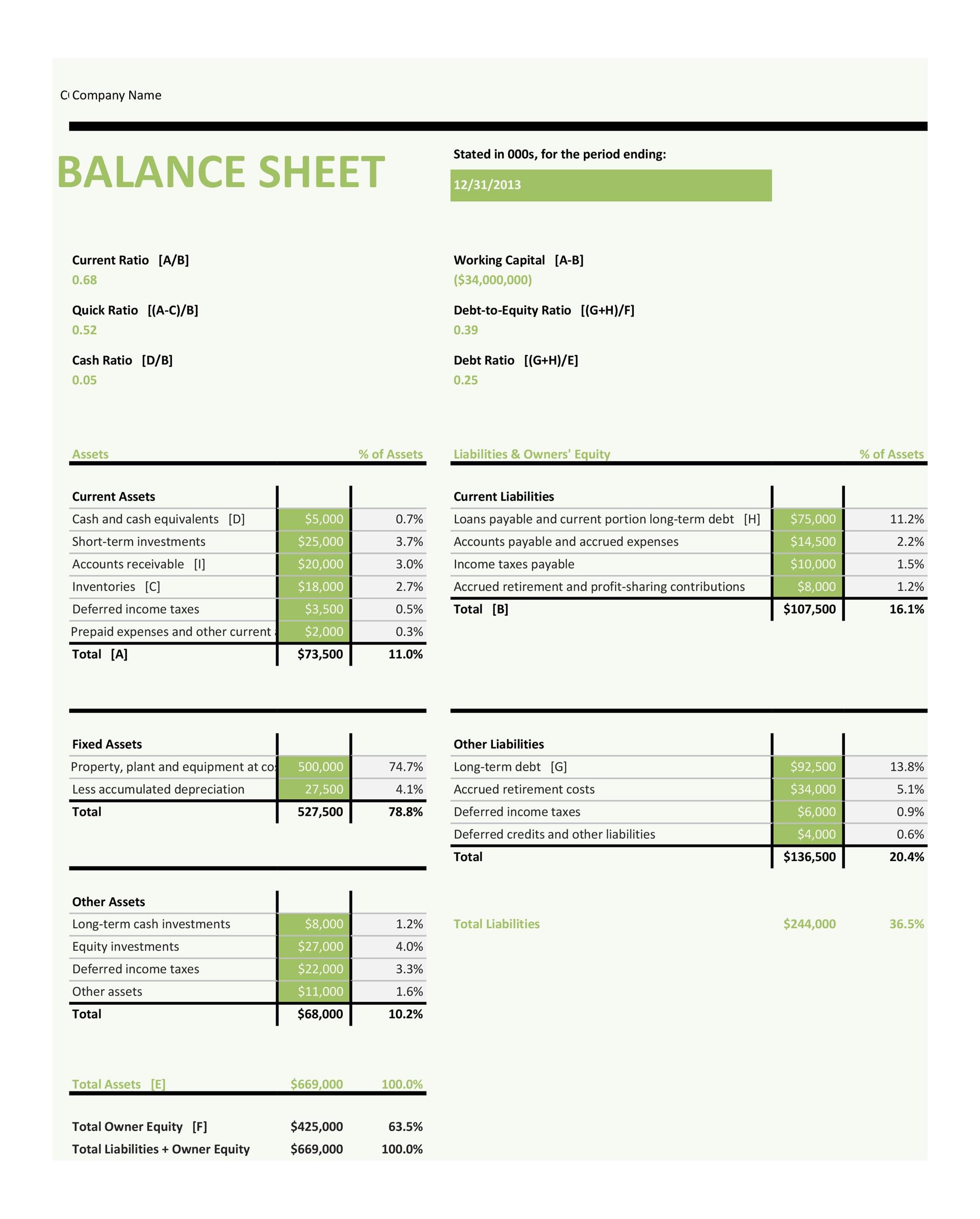

Many different financial ratios can be calculated from the information on a balance sheet. The assets are made up of fixed and intangible assets, bank, stock and debtors. Assets – Fixed Assets, Current Assets, intangible assets, stock, cash, money owed from customers (accounts receivable ledger) and prepayments. Fixed assets or long-term assets are things a business owns that it plans to use for a long period of time.

C. Profitability Ratios

Public companies are required to have a periodic financial statement available to the public. On the other hand, private companies do not need to appeal to shareholders. That is why there is no need to have their financial statements published to the public. It is crucial to remember that some ratios will require information from more than one financial statement, such as from the income statement and the balance sheet.

Calculating working capital requirements (WCR)

To simplify bookkeeping, she created lots of easy-to-use Excel bookkeeping templates. Finally, unless he improves his debt-to-equity ratio, Bill’s brother Garth is the only person who will ever invest in his business. The situation could be improved considerably if Bill reduced his $13,000 owner’s draw. Unfortunately, he’s addicted to collecting extremely rare 18th century guides to bookkeeping. Until he can get his bibliophilia under control, his equity will continue to suffer. Finally, since Bill is incorporated, he has issued shares of his business to his brother Garth.

Everything You Need To Master Financial Modeling

This balance sheet also reports Apple’s liabilities and equity, each with its own section in the lower half of the report. The liabilities section is broken out similarly as the assets section, with current liabilities and non-current liabilities reporting balances by account. The total shareholder’s equity section reports common stock value, retained earnings, and accumulated other comprehensive income. Apple’s total liabilities increased, total equity decreased, and the combination of the two reconcile to the company’s total assets.

Although the balance sheet is an invaluable piece of information for investors and analysts, there are some drawbacks. For this reason, a balance alone may not paint the full picture of a company’s financial health. As described at the start of this article, a balance sheet is prepared to disclose the financial position of the company at a particular point in time. For example, investors and creditors use it to evaluate the capital structure, liquidity, and solvency position of the business. On the basis of such evaluation, they anticipate the future performance of the company in terms of profitability and cash flows and make important economic decisions. The balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities, and owner’s equity of a business at a particular date.

There are many sub-components that are recorded under shareholders’ equity. These include Common Stock, Prefer Stock, Retained Earnings, and Accumulated Other Comprehensive Incomes. In this article, we’ll explain everything you need millennials heres how to attract hire and keep them happy. you need to know about a business’s balance sheet. A higher debt-to-equity ratio means the company relies more on debt to finance its operations. This could signify financial trouble if the debt is not being paid back.

The current ratio measures the liquidity of your company—how much of it can be converted to cash, and used to pay down liabilities. The higher the ratio, the better your financial health in terms of liquidity. Because it summarizes a business’s finances, the balance sheet is also sometimes called the statement of financial position.

The data and information included in a balance sheet can sometimes be manipulated by management in order to present a more favorable financial position for the company. It may not provide a full snapshot of the financial health of a company without data from other financial statements. Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity. When a balance sheet is prepared, the current assets are listed first and non-current assets are listed later. Cash flow statements track a company’s financial transactions, showcasing money flow in and out during a specific timeframe. These statements break down cash movements into investing, financing, and operating activities.

When creating a balance sheet, start with two sections to make sure everything is matching up correctly. On the other side, you’ll put the company’s liabilities and shareholder equity. For example, even the balance sheet has such alternative names as a “statement of financial position” and “statement of condition.” Balance sheet accounts suffer from this same phenomenon. Fortunately, investors have easy access to extensive dictionaries of financial terminology to clarify an unfamiliar account entry.